For those who are interested in German market for micro-living and student housing, we have taken a look into our data to figure out some facts which may improve the understanding of the German student housing market.

Identifying tense student markets

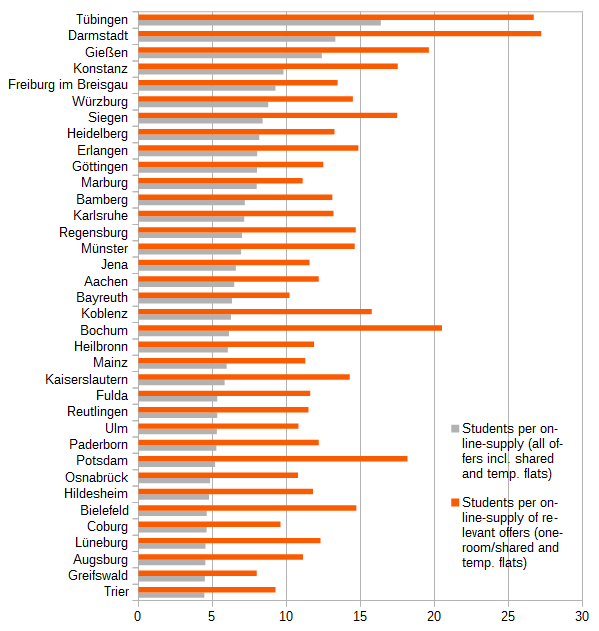

The university cities show the highest student demand excess, measured by students per online ads [(students – students in residence halls)/online offers)] , especially in student compatible sub-markets (‚one-room-flats‘, ’shared flats‘ and ‚temporary living offers‘). In Tübingen and Darmstadt there are more than 25 students for each student compatible residence offer.

Shared flats are an essential sub-market

We found out, that the market segment ’shared flats‘ is essential and valuable in context of analysing student housing markets as well as for micro-living issues.

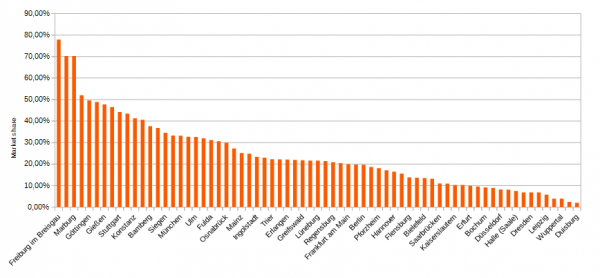

High market shares of ’shared flat offers‘ indicate student markets, as well as markets with high demand for ‚one-room-flats‘ and ‚micro-apartments‘. Rates for ’shared flats‘ also indicate accepted market rents, their upper percentiles show a critical willingness to pay and their spatial distribution indicates student hotspots. Despite these aspects the segment is hardly under investigation.

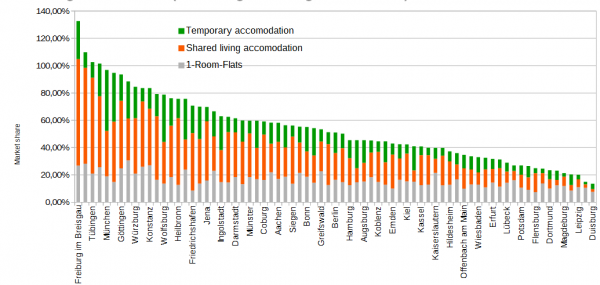

In most German student cities, their market share is higher than 20%-30%, up to 70%-80% in Freiburg, Tübingen and Marburg. In the ‚cheap‘ markets the share is lower which suggests that rent savings are an important reason for choosing shared accommodation forms.

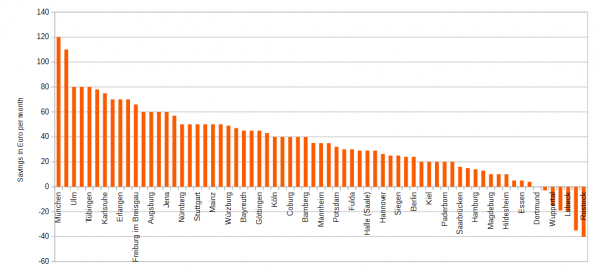

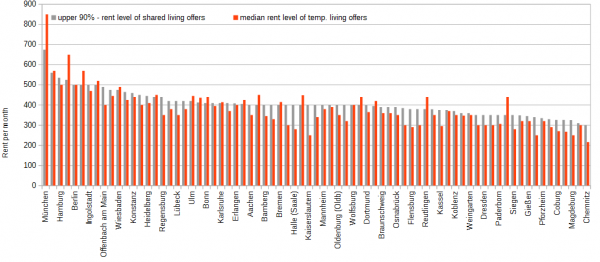

Shared living is not only a lifestyle, this accommodation type is also chosen because of hard facts, namely the opportunity of rent savings and/or poor supply of small and affordable flats. The following chart illustrates average rent savings per month, which can be reached by choosing a ’shared-flat‘ instead of a ‚one-room-flat‘. In Munich and Reutlingen median rent savings are higher than 100 Euro per month. Between 60 and 80 Euro can be saved in the university cities Ulm, Darmstadt, Tübingen, Heidelberg, Karlsruhe, Heilbronn, Erlangen, Gießen and Freiburg im Breisgau.

In markets with high demand excess for ‚one-room-apartments‘ many students have to resort to residential communities. Thus, this segment functions as market buffer which links ’small flats‘ / ‚micro-apartments‘ and ‚bigger flats‘. Therefore, the focus of analysis should not be limited to conventional small residences.

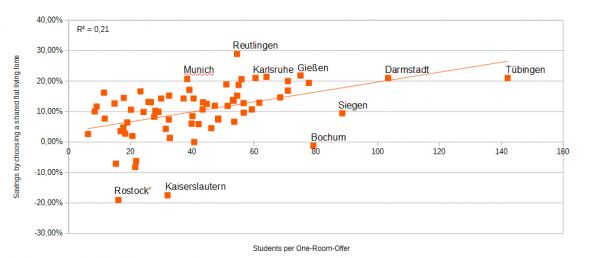

A high demand excess for ‚one-room-flats‘ leads to a high demand for shared living accommodations because of possible savings. There is a significant correlation between demand excess in the one-room-sector and possible rent savings by shared living.

While the boundaries between the different student specific sub-markets are unclear, one should pay more attention to the buffer segment ’shared flats‘. In Munich and Stuttgart temporary flat rents are significant higher than the upper rent level (90%) of ’shared flats‘, but in most markets, the rent level is equal (or lower) than rents for ’shared flats‘. The upper rent level of ’shared flats‘ may be a proxy value for the willingness to pay of most students.

In a comprehensive view, we notice that the student relevant segments are mostly represented by ’shared flats‘. ‚Temporary living accommodation‘ is relevant in the Top 7 (Munich > 40%, Stuttgart > 30%) but even in the big labour markets (Wolfsburg > 30%, Ingolstadt > 20% ).

The quantity of ’shared flats‘ and their linking character to the other segments shows, that shared flats are an essential sub-market in analysing student housing markets and conventional residential markets.

It is a challenge to identify this special advertisements on the online market places, but as reward you gain a better market insight into the student sector and a cleaner observation in the conventional market. If ’shared-flat-offers‘ are excluded of student housing analysis, a big part of it is not under observation. If ’shared-flat-offers‘ are not eliminated of conventional market rent observations, this leads to a statistical bias – due to community living spaces in the ’shared flats‘, which are not listed in the advertisements, but surely are an element of their rent.

Questions/data/access?

Contact us if you want this ‚analysis‘ for free, or if you like a free trial access to our data-base to analyse the markets on your own!

Sources:

1. Places in residential halls and number of students ( http://www.datenportal.bmbf.de, Deutsches Studentenwerk, Wohnraum für Studierende; Deutsches Zentrum für Hochschul- und Wissenschaftsforschung, Berechnungen, Data licence Germany – attribution – Version 2.0)

2. All other data: empirica-systems Market-Data-Base

empirica-systems Market-Data-Base

Our real estate ‚Market-Data-Base‘ provides an up-to-date and detailed market overview for Germany. It enables portfolio analyses, location analyses as well as cross-site market analyses. Our high quality data are a solid decision support for transaction processes, valuations and lettings.

empirica-systems Analyst

Our cloud-based information system, the ‚Analyst‘ provides data and evaluations in real time: consultants, brokers and developers use the Analyst as well as investors, research companies, asset managers or housing companies. In addition, authorities use our data for decision support.