VALUE AVM is a fully comprehensive solution for automated value indication and system-supported derivation of market and collateral values.

The solution is suitable for users who are interested in a fast and precise automatic valuation. Experts and valuers who want to derive an ImmoWertV or BelWertV-compliant market or mortgage lending value also benefit from VALUE AVM due to a large amount of valuation-relevant data and efficient handling.

The solution is suitable for users who are interested in a fast and precise automatic valuation. Experts and valuers who want to derive an ImmoWertV or BelWertV-compliant market or mortgage lending value also benefit from VALUE AVM due to a large amount of valuation-relevant data and efficient handling.

Application areas

VALUE AVM is thus an optimal tool for sales and back office issues in banks. It offers exact market and mortgage lending value indications as well as efficient system support for the valuation. The system offers a range of solutions for all relevant valuation procedures in accordance with the legal requirements, including tangible asset value, capitalized earnings value and comparative value procedures.

After only a few obligatory parameters have been entered, a value indication with value ranges and confidence data is generated within milliseconds, with the option of intervening in the valuation at any time. The return of necessary valuation-relevant data for the further process supports the expert in deriving the value. In addition, VALUE AVM offers important research and benchmarking tools.

Data basis

The VALUE AVM is based on actual transaction data, which is enriched with information from the VALUE market database and relevant neighborhood and location information. This provides a data basis with a particular depth of information.

In total, the VALUE AVM models draw on over 3 billion data points from more than 18 million transactions and offers, which undergo a four-stage, recursive filtering and modeling process. In addition, the valuation bases and land value information from the appraisal committees are used. All data used is continuously processed and checked for plausibility according to the proven quality standards and process chains of the VALUE market database.

Valuation model and model quality

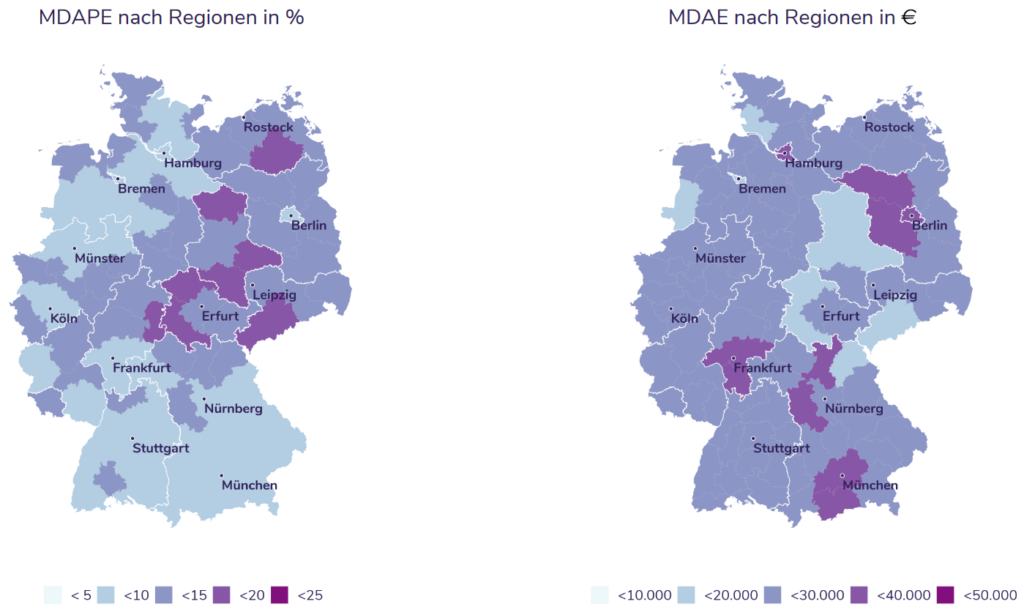

The core module of VALUE AVM is the comparative value model. This is calculated regionally as a flexible parametric model, so that it is ultimately based on 649 separately optimized individual models. The quality of the model is ensured by regular backtesting against actual transaction data in accordance with current EBA requirements. The high quality of the model is reflected in a low average absolute deviation, which is below 10% across all tested estimators. In particular, however, the Q20 range indicates very high model quality at around 85%. Since the percentage error varies regionally, we return the region-specific model quality, information on the data basis and the mean error of the region for each estimate. In this way, we contribute to transparency and traceability.

The following maps show the region-specific error as MDAPE (Median Absolute Percentage Error) and once as MDAE (Median Absolute Error) as of 04’2022.

The other relevant models for determining the market adjustment factors or the property rates are also derived on the basis of suitable data, but in some cases are determined independently of the comparative value model using different model approaches.

More valuation tools

VALUE AG’s digital valuation toolbox contains even more: Our comparison price algorithm selects the most suitable comparison projects for each property entered. The VALUE Location Engine offers micro and macro location scoring as well as land values and climate risks for all addresses. The VALUE rental value indication provides nationwide market rents and existing rents with extremely high estimation quality and the energy value indication estimates an energy consumption value and the corresponding CO² emission for any residential property, by the way a proven tool for numerous questions in the field of ESG.

VALUE AG’s digital valuation toolbox contains even more: Our comparison price algorithm selects the most suitable comparison projects for each property entered. The VALUE Location Engine offers micro and macro location scoring as well as land values and climate risks for all addresses. The VALUE rental value indication provides nationwide market rents and existing rents with extremely high estimation quality and the energy value indication estimates an energy consumption value and the corresponding CO² emission for any residential property, by the way a proven tool for numerous questions in the field of ESG.

Interface

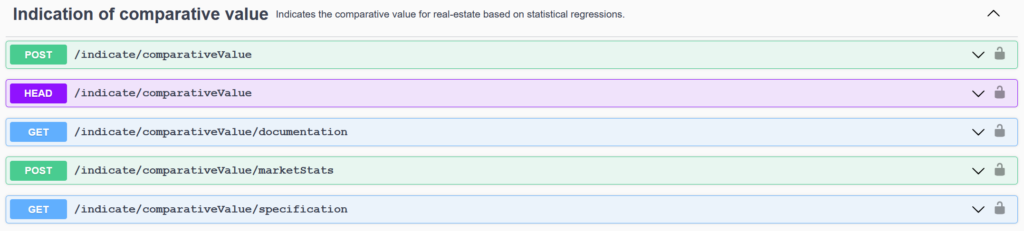

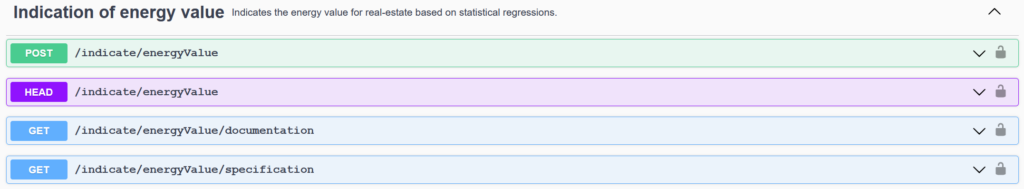

All modules from VALUE AVM are managed as separate REST API endpoints and can be licensed individually. A complete solution is also available. With the VALUE Endpoint, all relevant process values can be derived with one query. In addition, the endpoint provides information on the financeability, the blank amount and the required equity.

Details of the procedures and endpoints

Below we provide an overview of the available endpoints.

Comparative value method – model-based comparative value indication & object-based comparative value indication

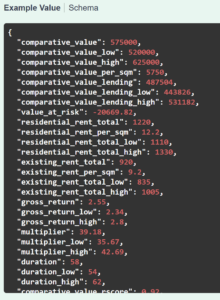

For the comparative value method, both model-based comparative values (hedonic method) and comparative objects are issued. For each estimate, information is provided on the model quality, the data basis and the confidence. The algorithm also provides information on market rents and in-place rents. For the mortgage lending value indication the safety discount can be individually adjusted in accordance with §19 (1) BelWertV. For investors, the comparative value indication also provides an output on VaR (value at risk).

For the comparative value method, both model-based comparative values (hedonic method) and comparative objects are issued. For each estimate, information is provided on the model quality, the data basis and the confidence. The algorithm also provides information on market rents and in-place rents. For the mortgage lending value indication the safety discount can be individually adjusted in accordance with §19 (1) BelWertV. For investors, the comparative value indication also provides an output on VaR (value at risk).

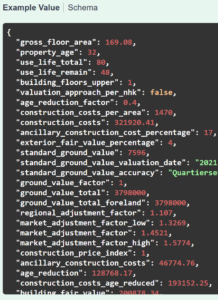

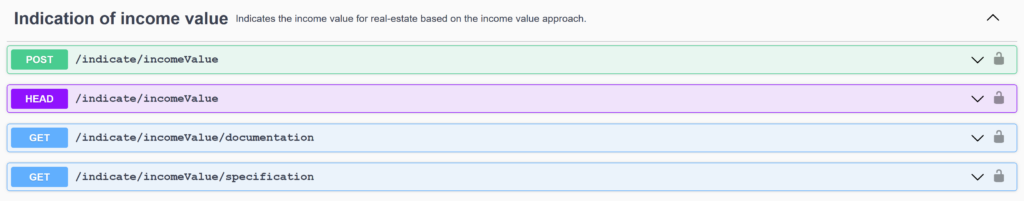

Real asset value method – NHK or BKI based real asset value indication

In addition to land values, suggestions for market adjustment factors, including range values, are also provided for the real asset value method. In addition, the other valuation-relevant data, such as construction price index or regional adjustment factor, are provided. For mortgage lending value indication, the safety discount can be individually determined in accordance with §16 (2). Value restrictions in accordance with §16 (3) are automatically transferred and documented accordingly as a message. The value output contains all relevant interim calculations and assumptions for the determination of the asset value.

In addition to land values, suggestions for market adjustment factors, including range values, are also provided for the real asset value method. In addition, the other valuation-relevant data, such as construction price index or regional adjustment factor, are provided. For mortgage lending value indication, the safety discount can be individually determined in accordance with §16 (2). Value restrictions in accordance with §16 (3) are automatically transferred and documented accordingly as a message. The value output contains all relevant interim calculations and assumptions for the determination of the asset value.

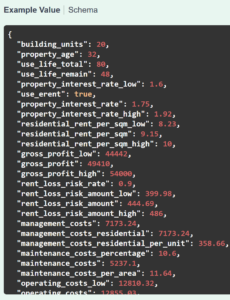

Income valuation approach – income value indication incl. rent plausibility check

With the income value indication, property interest including margins, residential and commercial rents as well as the region-specific rent default risk and land value suggestions are delivered. The management cost estimates are deposited according to the German income value guideline. The requirements of §13 BelWertV are taken into account and implemented or issued as a report. The value output contains all relevant interim calculations and assumptions of the capitalized earnings value calculation. For investors, the capitalized earnings value indication also provides an output on VaR (value at risk).

With the income value indication, property interest including margins, residential and commercial rents as well as the region-specific rent default risk and land value suggestions are delivered. The management cost estimates are deposited according to the German income value guideline. The requirements of §13 BelWertV are taken into account and implemented or issued as a report. The value output contains all relevant interim calculations and assumptions of the capitalized earnings value calculation. For investors, the capitalized earnings value indication also provides an output on VaR (value at risk).

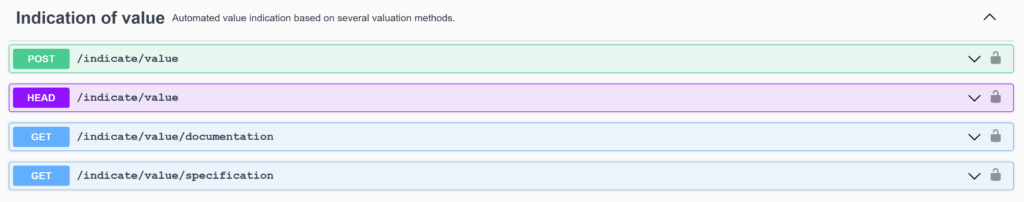

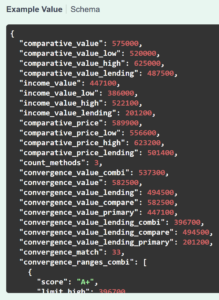

Complete solution – multi-track value indication

With the VALUE Endpoint, we offer all relevant valuation procedures in one module. VALUE AVM takes up the multi-track procedure of the appraiser in the context of the market and mortgage lending value determination and combines independent procedure values to an indicative market value. This is labeled as a convergence value in the context of the indication. The convergence value combines the relevant procedural values on a weighted basis. The module provides all intermediate calculations of the relevant procedure values and bundles them to the respective final value. We are convinced that the multi-track approach to value determination provides the best possible value corridor, even in the context of automated procedures. The convergence value thus corresponds to an indicative market value that is more robust to model or estimation inaccuracies and erroneous inputs than conventional approaches.

With the VALUE Endpoint, we offer all relevant valuation procedures in one module. VALUE AVM takes up the multi-track procedure of the appraiser in the context of the market and mortgage lending value determination and combines independent procedure values to an indicative market value. This is labeled as a convergence value in the context of the indication. The convergence value combines the relevant procedural values on a weighted basis. The module provides all intermediate calculations of the relevant procedure values and bundles them to the respective final value. We are convinced that the multi-track approach to value determination provides the best possible value corridor, even in the context of automated procedures. The convergence value thus corresponds to an indicative market value that is more robust to model or estimation inaccuracies and erroneous inputs than conventional approaches.

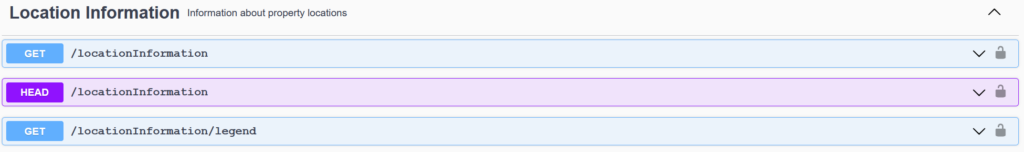

Location information – land value information and location classification

The VALUE location information engine provides ground values on demand and German-wide location classifications with regard to macro and micro location. If it is not possible to obtain ground values, the service uses fall-back solutions from established providers or provides fall-back values derived from models. The location classification provides a classification of the micro and macro location based on extensive price evaluations over 5 classes (1= simple to 5 = excellent).

The VALUE location information engine provides ground values on demand and German-wide location classifications with regard to macro and micro location. If it is not possible to obtain ground values, the service uses fall-back solutions from established providers or provides fall-back values derived from models. The location classification provides a classification of the micro and macro location based on extensive price evaluations over 5 classes (1= simple to 5 = excellent).

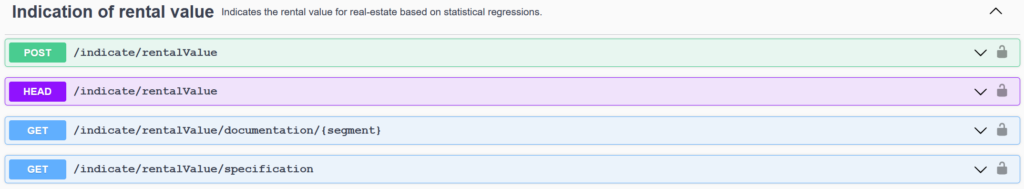

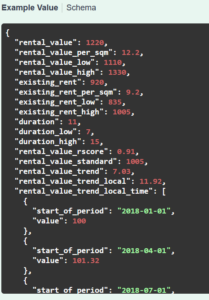

Rental Value Indication – Robust Market and In-place Rent calculation

With the VALUE rental value indication, we provide a rental price for each property that is based on comparable properties in the region, taking into account property-specific characteristics. With a mean absolute deviation of less than 7%, the VALUE rental value indication provides an extremely precise estimate of the market rent level. The market rent level from the past can also be estimated with the VALUE rental value indication. Thus, with the VALUE rental value indication it is also possible to derive existing rents (in-place) taking into account different rental periods. For the VALUE rental value indication, we use the market rents and the existing rents from the VALUE market database.

With the VALUE rental value indication, we provide a rental price for each property that is based on comparable properties in the region, taking into account property-specific characteristics. With a mean absolute deviation of less than 7%, the VALUE rental value indication provides an extremely precise estimate of the market rent level. The market rent level from the past can also be estimated with the VALUE rental value indication. Thus, with the VALUE rental value indication it is also possible to derive existing rents (in-place) taking into account different rental periods. For the VALUE rental value indication, we use the market rents and the existing rents from the VALUE market database.

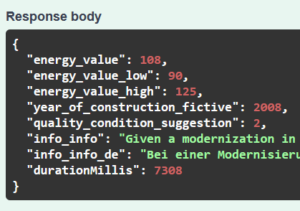

Energy value indication – energy consumption and emission characteristic values of any property in Germany

The VALUE energy value indication provides a reliable property- and region-specific energy value in KWh per m² and year as well as a specific CO2 emission value depending on the region-typical type of firing in KG-CO2 per m² and year. The underlying model is based on the VALUE market database, in which we have processed over 7 million energy performance certificates. By combining the geolocation, the property type and the year of construction, as well as the optional modernization year (fictitious year of construction), the underlying model delivers the output values after only a few inputs. The VALUE energy value indication is an optimal tool for the structuring and screening existing portfolios according to ESG or Taxonomy issues.

The VALUE energy value indication provides a reliable property- and region-specific energy value in KWh per m² and year as well as a specific CO2 emission value depending on the region-typical type of firing in KG-CO2 per m² and year. The underlying model is based on the VALUE market database, in which we have processed over 7 million energy performance certificates. By combining the geolocation, the property type and the year of construction, as well as the optional modernization year (fictitious year of construction), the underlying model delivers the output values after only a few inputs. The VALUE energy value indication is an optimal tool for the structuring and screening existing portfolios according to ESG or Taxonomy issues.

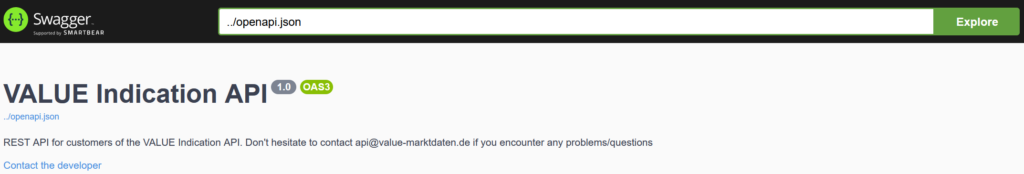

Access with JSON based REST-API

All assessment solutions and research tools are provided as JSON based endpoints in our REST API. They are licensable on a modular basis or as a complete package. Prices vary depending on the scope of use.